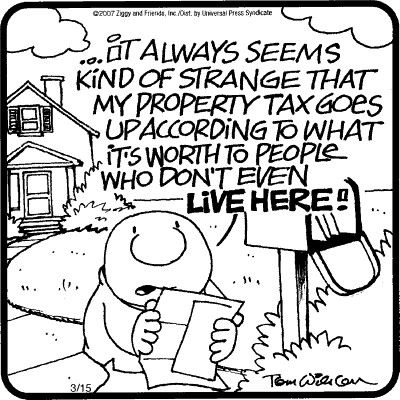

Just spent the last 3.5 hours writing up a proposal politely suggesting to Wake County that their assessment of my home’s tax value was utter bollocks and suggesting a more appropriate number for them to use.

After going through this in 2016, I had thought that I had four more years to play with as NC counties normally only do this once every eight years but our friends at the assessor’s office want to strike whilst the Wake County property market is insanely overheated right now. You can bet we’ll quickly go back to the eight-year maximum cycle between revaluations if the economy goes to hell in the next four years…

Anyway, if you were as horrified by the proposed assessment value as I was…you can (and should!) challenge their value using comparable sales prices from 2018-2019 to determine fair market value as of 01 Jan 2020.

Fortunately, it’s relatively simple to do so with a little bit of homework and a lot of patience. If you look up your property on the tax assessor’s website, you can find the properties they’re comparing to yours and their most recent sales price. They’ve even made it easier this year by providing a button that will filter out all but the ones that they’re comparing to your property. Only recent sales are going to be considered (unless you have a recent enough appraisal that they will accept) so forget the view that shows all of the sales from 2010 or so…if you want to be successful, the most you can look back is two years if you don’t have a lot of property turnover in your area.

Don’t be surprised if the comparable sales they offer don’t even come close to the assessed value they’re trying to stick you with. Their system treats the land and building(s) as separately assessed line items even though no one purchases an existing house that way. But it is illuminating to see just how much padding of the fair market value they’re trying to get away with which often works out to be very close to the assessed land value.

That is a key thing to keep in mind…every government in this country that taxes property on an ad valorem basis prices in a huge markup in a revaluation knowing that the vast majority of property owners won’t even bother to spend the couple of hours to challenge and defend a much lower and fairer value.

From that list of properties, look to see if they are comparable to your home in terms of size and quality. The most expensive of the four that Wake County wanted to use against me is 800 square feet larger than my house! I argued successfully in 2011 that houses that were 200 square feet larger weren’t fairly comparable so I feel pretty safe tossing this one overboard as a statistical outlier.

The three remaining properties were relatively evenly distributed on either side of the median priced property so I argued that counteracting the skew from the most and least expensive ones in favour of the mean value is a fairer representation of true fair market value. To support that, I found a house across the lake behind my house of similar size to the three being compared that sold on 19 Dec 2019 that was very close to both the median value and the value I was proposing.

Unless Wake County decides that they want to be stubborn and refuse to consider a reasonable value, I would expect the informal review to come down in my favour.

If not, then I have no problem defending my proposed value to the Wake County Board of Equalization and if they’re equally unreasonable, then we’re off to see the State Property Tax Commission.

Been there, done that in 2011! When it came time to meet Mr Kinrade and the county attorney a week prior to our hearing date in front of the PTC and exchange the briefs we were going to argue…when they saw I had effectively trashed the three properties they wanted to use, the attorney (not quietly enough!) suggested that the assessor’s office needed to settle or they’d lose big and look silly in the process.

Sometimes it takes going all the way to the PTC…when I did this in 2011, I’m quite sure the members of the Board of Equalization had unofficial orders to say no to everyone in the hearings. They certainly did more than a few times to people whose claims were even stronger than mine and they were hoping the majority of people would give up rather than appeal to the PTC! The Great Recession had done a number on property values and Wake County was trying desperately to hold onto the values from the 2008 revaluation which were much higher than what I had to use in 2011.

In 2016, the assessor actually dropped my property’s assessment by 5% and I didn’t see any reason to go argue with them…based on the numbers, they actually hit a fair number for tax purposes without too much padding.

May you have a successful appeal! 🙂