Even when you’ve been preparing tax returns for what seems forever but in reality is almost my entire life (!), there is still that moment of anxiety when you’ve pushed the button to electronically file a client’s tax return where you’re wondering if you’ve forgotten something that’s going to cause it to be rejected by the IRS or Department of Revenue.

It happens to us all, even those of us compulsive types who reviewed the return about three or four times before sharing it with the client who may well wonder if we were toilet trained at gunpoint!

After all, electronically filing is akin to physically dropping that big envelope full of tax accounting into a mailbox with pretty much a zero chance of getting back when you’re having that crisis of conscience.

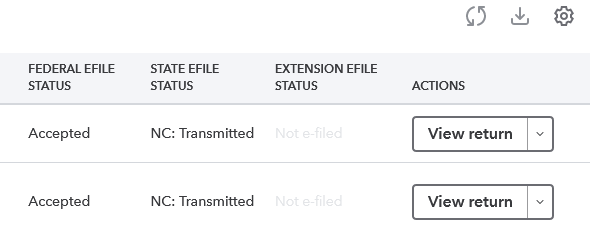

So you can imagine the relief when I saw the status page in the professional tax portal I use undergo a slight change in status for the two returns I’d fired off into toward the IRS computers as a massive set of of IP packets not too long ago this evening…

I’ve found that generally when the IRS computers have blessed the electronic return submission, North Carolina will inevitably reward that return with an accepted status a few hours later and now it’s safe to breathe a sigh of relief until next year.

And that’s when this geek who moved heaven and earth to ensure that the pink wedge in Trivial Pursuit was not going to be the total Achilles heel it was couldn’t help but think of this pop culture moment from “Ghostbusters”… 😉