One of the unbridled joys of tax preparation season is unearthing a relevant document from the pile of tax-related papers upon which it was tossed nine months prior with every intention of dealing with it that week only to have life intervene and other crises divert our attention.

Such was the case with a rental check from one of the coal mineral rights leases in southern Illinois that’s passed through several generations of Dad’s family to me. To my horror, I realised that I hadn’t actually deposited that particular check into my account at the credit union and now we’re nine months down the road in the unpleasant land of a stale check.

I’m sure long-time readers know this is going to become a bit of a deep-dive rant in the style of John Oliver’s “Last Week Tonight” (only without the vulgarity or profanity which whilst it’s entertaining on television does nothing to advance disputes of this nature).

Let me be clear here…even though I’m not a particularly happy bunny with Coastal Credit Union right now, I’ll be the first to tell you that a bad interaction with the credit union (much like this one with Navy Federal Credit Union a while back) still beats a great day spent in a commercial bank. And once I’m done venting a bit here, I’ll get past this situation and still remember that the rare annoyance doesn’t come close to the absolute hatred I have of the big banks and why I’ve done the vast majority of my banking in credit unions for well over 30 years and I don’t intend to change that any time soon.

Starting off and to be as fair as possible, I’ll be more than willing to hold my hand up and admit to breathtaking stupidity in not depositing the check straightaway which was compounded by the blithering idiocy of tossing it on a pile of documents in a home office full of those sorts of piles and then forgetting about it until the recent archaeological expedition unearthed this ancient check.

What I didn’t plan on adding to that litany of self-confessed ignorance was “trusting a financial institution to honour a commitment made by one of their employees”.

You see, I already knew I was in for some measure of a headache when I discovered the check and realised its age. But Coastal Credit Union has honoured older checks I’ve deposited in the past (though admittedly not one this stale) so I figured I’d do the honest thing and ring them up and get their opinion before just blithely trying to deposit it through the mobile deposit app on the phone (which has been a feature I’ve really loved).

The nice lady who answered at 0800 listened to my tale of woe and confessions of stupidity which included mentioning several times that the check was dated from last June so that there was no doubt what was happening here.

Interestingly enough, the check didn’t have the usual expiry language such as “void after 90 days” or “void after six months” which technically has no legal standing and banks can pay the check if they choose even if the language is there unless the entity writing the check instructs the bank in writing to not honour checks after that specified time period.

She suggested getting in contact with the coal company that wrote the check and checking to see if the check was still valid from their end. Should the company indicate that they hadn’t stopped payment on the check and it was theoretically still live and payable, Coastal wouldn’t stand in the way of me going ahead and depositing it.

I’ll admit that was a surprising answer as I expected her to just flatly tell me there’s no way they will honour it and that I needed to have a new rental check cut.

But trusting that she had more expertise on the subject than I did (which turned out to be a big mistake on my part), I went ahead and did as she asked and contacted the nice lady at the coal company and apologised profusely for adding to the hassle of her day by being an idiot and sitting on that check for so long but would she kindly see if it were still valid for deposit. After she checked with her trolls in accounting who presumably had verified they hadn’t explicitly stopped payment on the check, she gave me the thumb’s up to go ahead and do the deposit.

Believing what I’d been told earlier by Coastal, I fired up the mobile deposit app and let it do it’s thing and it initially seemed to work.

The next day was when I got the nasty surprise of seeing that the check had been rejected and the deposit was reversed. Mind you, the app doesn’t show you the status as to *WHY* it was rejected but I had no doubt it was the stale date which was later confirmed by the official letter.

I’m sure it will come as no surprise that I was on the phone with Coastal soon afterward and this is the rough play-by-play of how that went:

- I get first representative on the line and get put through the “security process” that involves giving the last four digits of my SSN over an unsecured phone connection. But it’s “for my security” even though anyone who has a cursory knowledge of the SSN not being unique and four numbers being enough to guess the other five makes even giving those last four numbers a risky proposition at best. Especially given how much damage the baddies can cause if they get your full SSN and just a couple of other pertinent details about you. Been there, done that…took three years of *SHEER HELL* to clean up the mess that with credit bureaus that judged me guilty and made me prove myself innocent.

- I explain to her the process that I’d been given the day before. That conversation was not noted in the customer relationship management system in use in the credit union (of course!) because why in the world would that information be useful in subsequent contacts?

- The agent asks me at one point if the person I’d been talking to was in a branch or in a call centre. That question struck me as odd at best because why should it matter where the person works in terms of the process being communicated? Knowing financial institutions as I do and how they tend to view the stone tablets of policy as some sort of sacrosanct set of commandments ordained by the Almighty that shall be obeyed forever and ever (amen!), it just made no sense that I should be told anything other than what policy dictates to them regardless of where they actually work.

- She eventually decides to transfer me to some sort of “payment operations” department.

- After a bit of time on hold, someone presumably in that department picks up the receiver and fumbles with it for a few seconds (you can clearly hear this bumping) before dropping it back into the cradle about five seconds later and disconnecting the line without having said a word. I’ve supported as well as rang up enough call centres in my life to know an intentional disconnect when I hear one.

- I immediately call back and ask the new representative to put me through to that “payment operations” department that had just intentionally dumped my call and she puts me back through the same farcical “security process” before she tries again to get someone in that department. I get the reason why but it’s still annoying especially when the person being subjected to it was an IT professional for decades who knows exactly how insecure if not outright dangerous to the consumer that “security process” is in practise.

- Now we’re on hold for over ten minutes with this new agent breaking in every now and then telling me she’s waiting for someone. The fact that no one ever picked up the call just confirms the intentional disconnect and at this point I’m thinking that the behaviours I’m experiencing are definitely approaching disciplinary levels.

- The agent decides that waiting on “payment operations” to deign to bother to give us any attention is hopeless and floats the idea of getting someone in the mobile deposits department instead. A couple more minutes of waiting (at which point I’ve transitioned to my vehicle because the kids did need collecting from school) and Heidi ends up taking the call.

- After once again repeating the story of what I’d been told the day before and that after complying with the process I’d been given to the letter, I ask the very simple question of “why am I having to make this call?”

- Heidi is the first person who definitively says that Coastal won’t honour a check after six months have elapsed. I’ll deal with the reasons why they’re entitled to do so later but the short version is that Regulation CC has some exceptions to the funds availability policy for checks, one of which is for checks they feel may not be honoured by the payee bank and stale checks are specifically called out in the commentary on the regulation as reasonable cause.

- That begs the question of why I was asked to verify the check was good with the coal company’s accountants if Coastal seems to have had no intention of ever honouring the check. And after having determined as best I could using the procedure given to me by Coastal that the check would be paid, why shouldn’t I expect Coastal to honour the commitments made by the first agent?

- Heidi repeats the policy and at this point I’m feeling that I’ve been lied to at least once (I don’t think it was necessarily intentional but a lie is a lie regardless of actual intent as far as I’m concerned). I tell her that any of my children would be able to swear out a statement that I’ve been very consistent with them every day of their lives that I might well be disappointed with their behaviour from time to time but that if they wanted to make things worse and make me truly angry with them and compound whatever punishment was to come their way, lying to me was the quickest way to do so. I can’t say they’ve not tested the proposition from time to time but I can assure you they’ve never had any cause to believe it wasn’t true!

- To prove the lie I am suspecting, I proposed a simple test. Can Coastal show me definitive proof that they actually tried to get Key Bank to pay the check or did Coastal just decide to not even try in spite of what I was told by the first agent. If Coastal tried to present the check and Key refused to pay it utilising the same policy on stale checks Coastal is enforcing, Coastal is then in the clear as far as I’m concerned and I’d have left it at “Coastal tried in good faith to make it work but sadly it didn’t because sometimes a certain smelly thing happens” and shifted to Plan B of getting the check reissued. If Coastal didn’t even try, then there’s the lie from the first day where I was promised a positive outcome if I followed the procedure I was given.

- Heidi eventually concedes that she can’t see anything in her system that shows Coastal tried to send the check through to Key Bank which is prima facie evidence they likely never did and could be argued based on the quoting of policy that they never had any intention of doing so.

- It’s clear Heidi has no intention of going against policy (and I can understand that to a degree) and equally as clearly won’t explore any other options (which I don’t accept), it’s pretty much at the point where I’m going be leaving this call disappointed and unsatisfied and writing this blog post as a cheap form of therapy.

- And whilst we’re at it, I’ll be sending the link to the powers-that-be at Coastal to see if they’re at all pleased with how this part-owner in the credit union’s affairs were handled over a rental check written for the princely sum of $34.11. I’ll be sure to write an update with any response if I get one.

To be as fair as possible (in spite of the snarky title), I do actually understand Coastal’s position in this dispute and there are some financial regulations that do back them.

Let’s start with the Coastal Membership and Account Agreement (the last version was issued in 2022).

Coastal Federal Credit Union Membership and Account Agreement (2022)

- POSTDATED AND STALEDATED CHECKS OR DRAFTS – You agree not to issue any check or draft that is payable on a future date (postdated). If you do draw or issue a check or draft that is postdated and we pay it before that date, you agree that we shall have no liability to you for such payment. You agree not to deposit checks, drafts, or other items before they are properly payable. We are not obligated to pay any check or draft drawn on your account that is presented more than six months past its date; however, if the check or draft is paid against your account, we will have no liability for such payment.

This is the only mention of state checks in the agreement and it only refers to stale checks that are written *FROM* your account, not stale checks that are being deposited *TO* the account.

But it does obliquely refer to the standard six month past the date of the check which is generally considered the cut-off as to when a check goes stale (with exceptions, Treasury checks last a year and other official checks may have different limits).

This comes from the Uniform Commercial Code (UCC) which is a set of model state laws that have been enacted by the states to provide a consistent legal framework for all commercial transactions in the United States.

§ 4-404. BANK NOT OBLIGED TO PAY CHECK MORE THAN SIX MONTHS OLD.

A bank is under no obligation to a customer having a checking account to pay a check, other than a certified check, which is presented more than six months after its date, but it may charge its customer’s account for a payment made thereafter in good faith.

Uniform Commercial Code, PART 4. RELATIONSHIP BETWEEN PAYOR BANK AND ITS CUSTOMER

Whilst the UCC says that the banks *MAY* refuse to honour a check older than six months, the second part of § 4-404 is what allows them to *CHOOSE* to honour a stale check.

The official rejection notice refers to the Federal Reserve check clearance system with this little blurb:

Coastal Federal Credit Union must be consistent with Federal Reserve check processing standards.

Fair enough.

The relevant bits can be found in the Code of Federal Regulations Title 12 (Banks and Banking), Chapter II (Federal Reserve System), Subchapter A (Board of Governors of the Federal Reserve System), Part 229 (Availability of Funds and Collection of Checks) which is more commonly known as Regulation CC in banker-speak.

Specifically we’re going to be looking at Subpart B which provides a framework of funds availability. Whilst the regulation refers to “banks”, it’s customarily interpreted to also apply to credit unions and other financial institutions.

For example, if you wondered where banks came up with the seemingly magical number of $225 (or less if the total of deposits) of your deposit that is generally made available by the next business day or two business days if not deposited in person, § 229.10 (Next-day availability) is where it is defined.

Indeed, Coastal’s mobile app check deposit functionality has that in blue right above the “Deposit to” field:

Please note: There is a 2 business day hold. The first $225 of your daily deposit is available immediately. Holiday and weekend deposits will be available the next business day.

Subpart B has a list of exceptions in § 229.13 of which the most relevant is (e) which covers “Reasonable cause to doubt collectability” as a reason to vary from the usual schedule of funds availability:

(1) In general. Sections 229.10(c) and 229.12 do not apply to a check deposited in an account at a depositary bank if the depositary bank has reasonable cause to believe that the check is uncollectible from the paying bank. Reasonable cause to believe a check is uncollectible requires the existence of facts that would cause a well-grounded belief in the mind of a reasonable person. Such belief shall not be based on the fact that the check is of a particular class or is deposited by a particular class of persons. The reason for the bank’s belief that the check is uncollectible shall be included in the notice required under paragraph (g) of this section.

12 CFR 229.13(e)(1)

If you dig into the official interpretations of this regulation, you’ll find that stale checks over six months old are called out specifically as one way satisfying the reasonable cause for the exception.

But this is where I have a problem with Heidi’s decision to dig in her heels on the stale check policy.

I had followed the procedure that I was given by the first agent I had proactively contacted to communicate with the coal company and after they had researched the validity of the check on their end, I feel that went a long way in resolving Coastal’s “reasonable doubts” exception safe harbour codified in 12 CFR 229.13(e).

Indeed, that was the whole point of the exercise.

I jumped through the hoops and did *ALL* of the legwork.

Now the ball should be in Coastal’s court as it were.

My reward was frustration and feeling hard done by in a situation that should have been handled much better.

At that point, I don’t think anyone would find it was unreasonable to expect Coastal to honour the commitments the first employee had made on their behalf as a representative of the credit union (whether they were *AUTHORISED* to make such a commitment is a completely different issue but one that I should not be held responsible for).

Mind you, just because the coal company’s accountants said everything was in order from their end didn’t necessarily mean that their bank (Key Bank) would have seen that check in the same light once it came through the system and was presented to them for payment. We will never know because Coastal never even tried to explore the possibility that Key Bank would have just gone ahead and paid it.

Even allowing for that, I can’t imagine that it would have greatly upset some cosmic balance of justice for Coastal to stand up and do the right thing for their member in spite of their employees not singing from the same sheet of music!

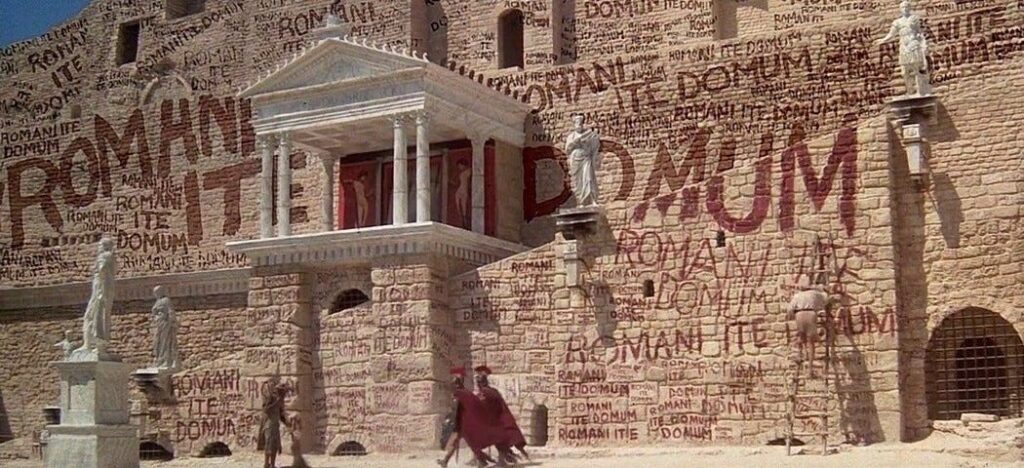

There’s a scene from Monty Python’s “Life of Brian” where Brian is threatened at sword-point by a Roman centurion to properly conjugate “Romans go home!” in Latin and then write it one hundred times on the wall or else something truly unfortunate would occur.

After he spends all night doing just that, a different (and likely sleep-deprived and bored!) centurion guarding him during his punishment tells him to “don’t do it again” before the first one comes back and realises the malicious compliance and starts chasing Brian through the town.

Perhaps something along the lines of “we’ll reverse the rejection this time but now that we’re all clear on the absolute and inviolable six month rule…DON’T DO IT AGAIN!”

Apparently that’s a step too far.

If Coastal is absolutely never going to consider honouring a deposited check more than six months old (which the UCC and the CFR allows), then they need to say so in no uncertain terms at every potential point of contact where a deposit may occur.

The first person should have just told me there was no chance of success and I’d have not wasted my time following a suggested procedure from someone who should have known better that was ultimately futile.

The membership agreement only refers to checks drawn on accounts and not deposits. The wording needs to be clarified there at the very least but I would strongly suggest going further and insuring that any avenue where deposits may occur have a warning of the situations that may cause a deposit to be reversed/rejected.

That would include the teller booths and ATMs and it is especially important in the mobile check deposit functionality of the phone app because the app has no visibility to the electronic documents functionality where the official PDF rejection notice (as well as statements and tax forms) is hosted by a third-party vendor.

I accept that it may not be possible for the mobile check deposit functionality to have a real-time answer as to whether or not it is kosher because there’s likely a human being eyeballing the images and giving the deposit the thumbs up or thumbs down after submission but even now two days later the status of the rejected deposit is still “Not Available”.

I think there are definitely some improvements that can be made in the transparency of the functionality.

And maybe at least in small way this miserable journey of discovery may have some sort of positive outcome.

As it is, I’ve already asked for the check to be replaced and I imagine the coal company will understand the reason why they have a little more hassle coming their way in spite of my best efforts.