Quite a while ago, I found myself having to find a new home for the corporate bank accounts after my current credit union refused to accept for deposit a check written to my corporation.

For the first time in over ten years!

And whilst that made me rather unpleased at the time, I ended up finding a lovely home for the business accounts thanks to USAA not offering business account services and my father being a very cooperative silent partner in getting me in via the field of membership.

Now, in order to get the business accounts, you have to open a personal savings account and use that to springboard into getting the corporate accounts.

The point of this whole exercise was to completely divorce the personal and corporate finances and so one of the questions was “could I deposit the bare minimum of $5 that I won’t touch ever again just to tick off that box on the sign-up forms?”

The answer was yes and truth be told, getting the accounts set up could not have been easier. I had a few questions that were answered by the customer support folks, the paperwork was handled all online, their technology and web portal are pretty darned good making it very rare that I even have to go into a branch, and all seemed well.

That is until I received this lovely letter out of the blue warning of an impending fee.

It didn’t actually mention which account had apparently offended their sensibilities but I couldn’t imagine it was the corporate ones because they have enough activity that they couldn’t possibly be mistaken for inactivity.

That left that little $5 saving account that I had actually completely forgotten about that had to be the culprit. It might have saved some time had there been some indication as to the account in question actually *IN* the text of the letter.

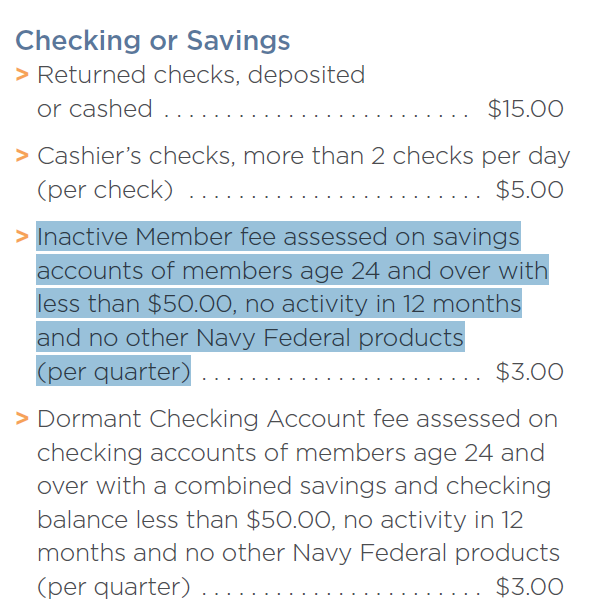

I end up digging through the disclosure documents to see what details I could find about this fee to see where I stood. After all, I really hate paying fees and of the options given, only #1 was at all plausible but I wasn’t all that keen on $45 going the wrong direction when it could be better used to deal with the rampaging inflation currently plaguing the country.

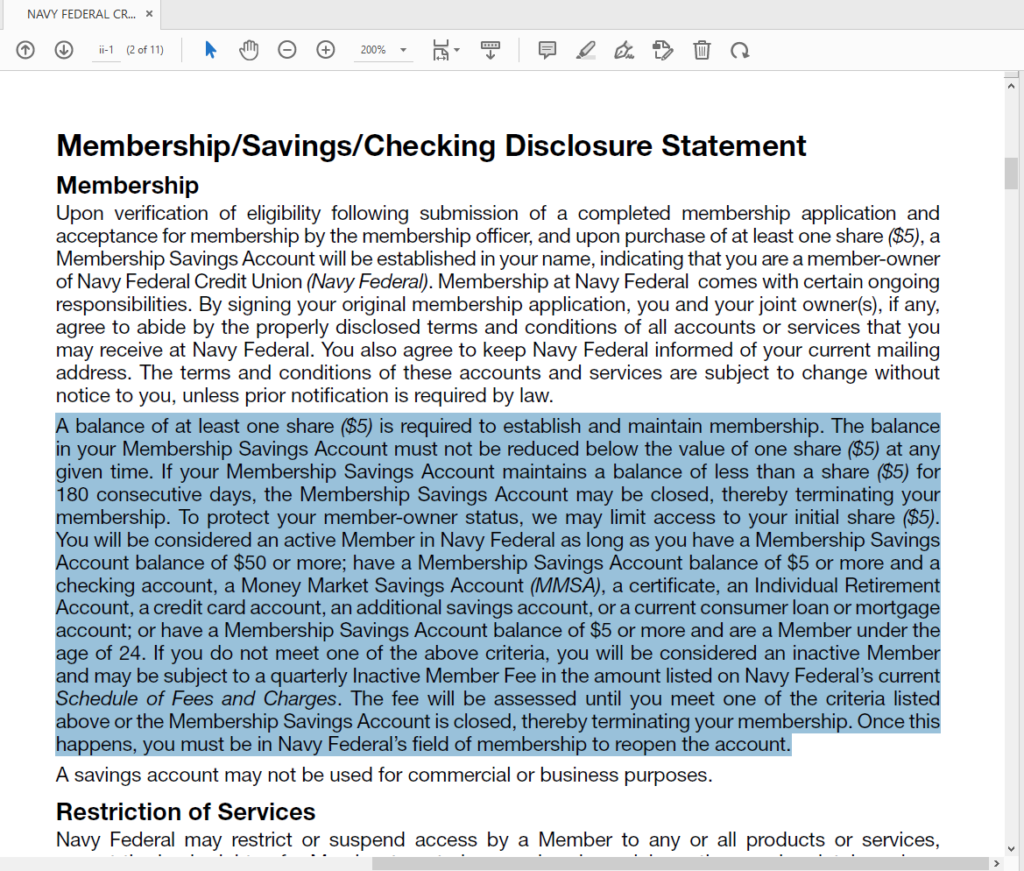

But wait a minute, I actually do have other Navy Federal products…two of them, in fact!

This document seems a bit more opaque but it doesn’t seem to rule out business accounts qualifying as a way of avoiding this unwanted fee.

With that in mind, that’s when I decide to ring them up on the 1-800 line and see if we can sort this out in a way that doesn’t include me increasing that deposit.

After all, I had good luck the two other times I’d called the support number which is extremely rare for me. Three would be an honest to goodness winning streak!

The first person I get is someone named Abraham and we’ve got to go through the usual silly “identity verification” procedure (“for my security” which is the height of irony!) that invariably includes me having to disclose part of all of my Social Security Number (SSN) over an unsecured telephone line.

I’m sure it won’t take much of a leap of the imagination just what I think of that but for those who are late to that party, here’s my main objections:

- The SSN is easily the most dangerous number to disclose to anyone because of the damage identity thieves can do. Too many institutions (government, financial institutions, and healthcare organisations) use that number as a primary identifier even though it is not guaranteed unique which breaks the whole point of a primary key.

- A lot of places want you to tell them the last four digits but have no clue that those four digits and one other piece of information about you can lead someone to successfully guess the other five digits. Once that happens, you’re royally screwed!

Once I get Abraham past his obsession with “verifying my identity” (which he really hasn’t done…he’s verified that I know the correct answers to the questions he’s asked which anyone with that data could easily do!), we get to the letter and why I’m ringing him.

The crux of my argument is that based on what I felt was a reasonable interpretation of the Statement of Fees and the Disclosure document text taken together about that fee, it should not apply as I do have other credit union products that are in active use.

Abraham takes the tack that it only applies to personal accounts/products and not the business ones.

The problem is that the documents don’t actually specifically say that only additional personal accounts qualify for the waiver.

When it comes to disputes such as this, the language of the contract and prevailing contract law reigns supreme. And one of the cardinal rules of contract law is that the contract provisions are contained within the four corners of the document that both parties agree constitutes the entirety of their relationship.

If you don’t believe me and the years of reading for the law I did at university, all you have to do is watch a couple of episodes of Judge Judy and “four corners of the contract” will invariably show up sooner than later! 🙂

Abraham was not going to be moved so off to his supervisor I go after a rather lengthy period on hold. I will say that the soundtrack they use is actually a really pleasant one rather than the usual crap elevator muzak interspersed with the robot lady’s bromides about how you’re a valued customer and they’ll be right with you (yeah, right!).

The supervisor Montrell turns up on the line and I try advancing the same arguments I’d made with Abraham but she’s actively resistant and at times rather insulting with the occasional side of imperiousness.

Nothing seemed to work…pointing out the deficient language of the contract documents that should specify that business accounts explicitly do not qualify for the waiver, the likelihood they’d fail in court with the “reasonable man in the street” test with that language, etc.

I even tried pointing out that I was completely up-front with the people who helped me open the account that I had no intention of using that one personal account other than to tick off a checkbox and the time to warn me that I really needed to deposit $50 rather than the $5 I did at the time to ensure I’d never ever worry about this fee was in that actual conversation. I had asked about that at least 2-3 different times and was assured that $5 in perpetuity was just fine.

I’m not suggesting that they were lying to me at the time…I think it more likely they genuinely didn’t think about this relatively obscure little fee because it’s so rare someone would open business accounts without also having more of their personal business in the same institution.

It would have been nice to have that heads up that my original plan had this flaw but it is what it is. No hard feelings.

I quickly came to the conclusion based on her attitude that her position on behalf of the credit union is that the tenets of basic contract law do not apply equally to them and me.

I’m expected to comply with every last provision of the contract even including the double-secret interpretations I have no way of knowing because they’re not actually in the contract documents and as far as I know don’t actually exist in reality.

But they’re free to pretty much do as they wish and interpret things to their benefit outside the four corners of the contract and I can just lump it.

So even though it complicates my bookkeeping and ties up money I’d rather not be frozen and unusable, it’s their way or the highway.

Message received.

After another hold, she tells me the drop dead date to either pay up the bung or expect to be nailed for that fee.

Montrell does say that she will write up my “concerns” and pass them along to “senior management” to review.

I realise I’m a kind of a glutton for punishment but I couldn’t help asking her when I could expect a response either via EMAIL or a voicemail from said senior management to close the loop and we know where we stand.

That’s when she floored me with the statement “they won’t contact you”.

Say what?!?

It got even more surreal when she seemed to be surprised that I’d find that to be a completely silly and broken business process!

- The whole point of feedback to the customer to close the loop is for us to end up at some point of common ground or at the very least a common understanding.

- It also helps ensure that whatever was “documented” for senior management substantially matches what actually came out of my mouth. I know this may come as a shock to some dear readers but I’ve found that what was “documented” in customer support often bore no tangible relationship to what I actually said but rather was worded to be what the person thought their senior management wanted to hear rather than what they truly *NEEDED* to hear and act upon.

- There’s also the matter of having at least a little confidence that someone in a position of authority theoretically took the time to consider the arguments carefully and come to a reasoned decision. When there’s no feedback *AT ALL*, the customer is left to find what confidence they can in the integrity of the organisation from what they experienced on the phone call.

Even if “senior management” ended up backing Abraham and Montrell’s seemingly “double-secret interpretation” and I’m stuck with the inevitability of paying the bung, at least there is a sense that there was some semblance of due process.

I might not be happy (and in this case I certainly wasn’t!) but I’d at least be in a place where I could at least understand.

And that’s why she failed the most important question I had asked her when she asked if she could help with anything else:

“Is there anything you can do where I don’t leave this phone call frustrated and pissed off?”

The silence spoke volumes well and above what a broken customer concern reporting process already did.

If you made it this far, please understand that dealing with two call centre representatives who were meh and rather authoritarian respectively isn’t going to override the generally top-notch service from the credit union I’d received up to that point.

I’m not going to be really thrilled when I go into the branch to pay this bung but hopefully that will eliminate any more hassle or letters about this particular problem.

I’ve found the rare times I’ve had to go in the branch to conduct some transactions to be pleasant and compared to my personal credit union, it’s actually refreshing interacting with real human beings rather than going up to an ATM-like booth with a video screen which isn’t even close to being the same experience.

But “senior management” needs to seriously consider fixing the broken feedback loop ASAP.

That’s assuming they ever learn about its existence in the first place! 🙁